Tax Credits and Incentives

South Carolinians with sufficient tax liability can take advantage of federal and state tax credits for the purchase and installation of a solar electric system to reduce the cost.

For a database of tax credits and incentives for solar, visit EnergySaver.SC.GOV.

Important note about tax credits: Tax credits can reduce a consumer’s tax liability, but the credits are non-refundable— meaning that they only apply if a consumer owes enough in taxes to balance the credit. Consumers will not receive a check if they do not owe taxes. Consult a tax advisor.

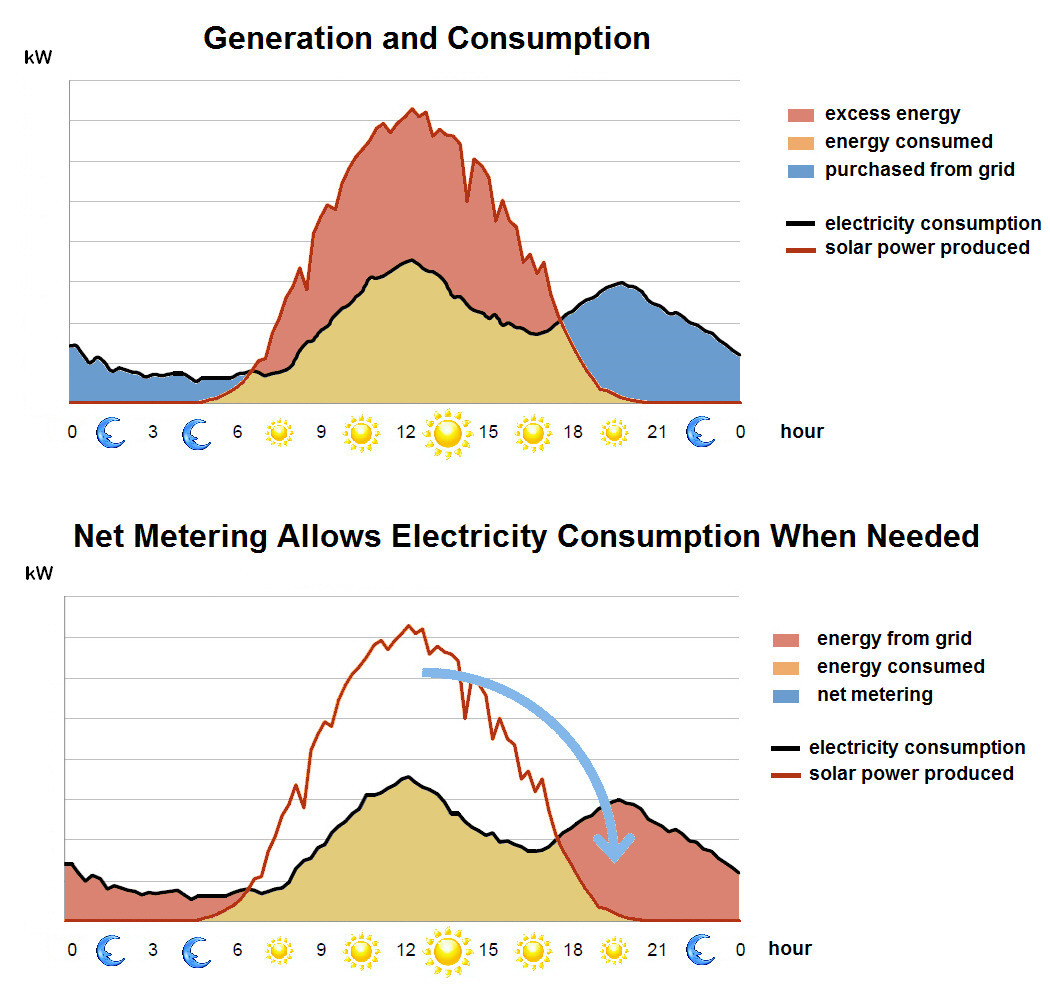

Net Metering

Net metering is an arrangement between utilities and consumers who produce their own power (through solar panels, for example). Consumers can be residential, commercial, or industrial consumers. If consumers produce more electricity than they use, they sell any excess power back to the utility as a credit on following months’ bills. That means a utility gives a consumer credit for every kilowatt-hour (kWh) of solar energy not consumed by their home and returned to the utility's grid, thereby reducing their electricity bill.

Net metering is an arrangement between utilities and consumers who produce their own power (through solar panels, for example). Consumers can be residential, commercial, or industrial consumers. If consumers produce more electricity than they use, they sell any excess power back to the utility as a credit on following months’ bills. That means a utility gives a consumer credit for every kilowatt-hour (kWh) of solar energy not consumed by their home and returned to the utility's grid, thereby reducing their electricity bill.

The dollar value of that bill credit can vary by state and by utility. “One-to-one” (sometimes called “full retail”) net metering means that the electricity produced by consumers is equal in value to the electricity produced by a utility. For example, if a consumer pays $0.10 per kWh for electricity from a utility, the utility will also give a credit for any excess power produced by the consumer at $0.10 per kWh. Some utilities offer bill credits at less than the one-to-one rate.

Current utility net metering programs can be found using the Energy Saver Tool. Search by Category “Solar” or by using the “For Your Home” of “For Your Business” selections.

Note: Please consult the utility for specific information and be sure to fully understand the utility’s net metering policies. Many utilities offer net metering, and most utilities impose additional fees related to the installation of solar electric systems. Talk to the utility to understand all fees and requirements associated with the installation of solar panels. Failure to take fees into account could significantly affect the financial return on investment. Electric cooperatives and municipal utilities may change their rules at any time.